By combining cutting-edge science and the largest custom network of fertility specialists in the nation, Progyny delivers superior clinical outcomes and shortens the path to pregnancy.

✓ Offered to Aetna and Capital BlueCross members; Kaiser members have their own benefit

✓ In vitro fertilization, egg freezing, surrogacy, and adoption education support

✓ Integrated pharmacy benefit through Progyny Rx

✓ Patient Care Advocates are available now to answer questions – call (833) 205-3998 from 9-5 ET.

Doctor on Demand is our virtual medicine provider offering on-demand or scheduled video visits with board-certified doctors and licensed psychiatrists and psychologists from your phone, tablet, or computer.

✓ Offered to Aetna and Capital BlueCross members; Kaiser members have their own benefit

✓ $10 copay* for general medicine visits | $25 copay* for behavioral health visits

*Cost higher for those in the Aetna Health Savings Plan until the deductible is met

Ditch the willpower. Register for the EX Program, a free digital program to help you quit all tobacco types - cigarettes, chew, vaping, and cigars. This 15-step approach from Truth Initiative in conjunction with the Mayo Clinic has helped almost 900,000 people quit for good.

✓ Includes eight weeks of quit medication - nicotine patches, gum, or lozenges delivered to your home

✓ Unlimited live chats with treatment experts

✓ 24/7 support from a thriving online community of people just like you

The Paper Store Medical has two onsite health clinics. The B. Well Centers are located at our Allentown, PA and Irvine, CA manufacturing facilities and provide care for annual physicals, colds, flu, sore throats, allergies, and more.

If you are not feeling well, you can call the B. Well Center for an appointment and be seen the same day at no cost to you.

You can also get a flu shot, certain adult vaccinations, or routine bloodwork. Whether you live, work, or are traveling in the area, the B. Well Center is available to take care of you.

✓ Hours of Operations: Monday through Friday 6:00 a.m. to 6:00 p.m.

✓ Allentown Facility: 901 Marcon Boulevard Second Floor Allentown, PA 18109 (610) 596-0700

✓ Irvine Facility: 2525 McGaw Avenue Irvine, CA 92614 (949) 660-2261

Covered at 100%

$5 / $10

$45 / $90

$60 / $120

$100 / $300

Covered at 100%

$5 / $10

$45 / $90

$60 / $120

$100 / $300

Covered at 100%

$5 / $10

$45 / $90

$60 / $120

$100 / $300

Find a Dentist

Summary of Benefits

Summary Plan Descriptions (SPD)

Brochures

Program Information

$75 (I) / $225 (F)

$1,000/person

Employee-only: $6.84

Employee + Spouse: $12.89

Employee + Child(ren): $12.89

Family: $23.45

$50 (I) / $150 (F)

$1,500/person

Employee-only: $10.76

Employee + Spouse: $19.35

Employee + Child(ren): $19.35

Family: $30.16

$50 (I) / $150 (F)

$2,000/person

Employee-only: $15.22

Employee + Spouse: $28.14

Employee + Child(ren): $24.42

Family: $43.86

You pay 0%

You pay 40% after deductible

You pay 50% after deductible

N/A

N/A

You pay 0%

You pay 10% after deductible

You pay 30% after deductible

You pay 50% of maximum plan allowance

$1,500/person

You pay 0%

You pay 10% after deductible

You pay 30% after deductible

You pay 50% after deductible

$2,000/person

If you use a Delta Dental PPO Non-panel Dentist who is also a non-participating dentist in Delta Dental’s traditional programs, you may be asked to file a claim. Claims payments will be made directly to you. It is your responsibility to pay your dentist. You are also responsible for paying the dentist the difference between his full charge and Delta Dental’s payment.

$5 copay every 12 months

$0 copay; Up to $150 allowance then 15% discount off any balance

$25

$200 Allowance Eye Plus INN $150 Allowance OON up to $120

Employee-only: $2.88

Employee + Spouse: $5.46

Employee + Child(ren) $5.75

Family: $8.46

$0 copay every 12 months

$0 copay; Up to $200 allowance then 15% discount off any balance

$10

$300 Allowance Eye Plus INN $250 Allowance OON up to $200

Employee-only: $5.38

Employee + Spouse: $10.22

Employee + Child(ren) $10.75

Family: $15.81

Program Flyers

Summary Plan Description (SPD)

Summary of Benefits

Life/AD&D - The Hartford

Long-Term Disability - Unum

A health savings account (HSA) is a medical savings account that allows you to use pre-tax contributions from your paycheck to cover eligible health care expenses, tax-free.

Individual: $4,300 | Family: $8,550

$1,000

You must be enrolled in the PPO Saver HSA in order to elect an HSA. If you enroll in the HSA, you may NOT enroll in the Limited-Purpose FSA.

A flexible spending account (FSA) is a tax-free reimbursement account funded by

pre-tax contributions from your paycheck.

A Healthcare FSA allows employees to set aside pre-tax dollars to cover eligible expenses such as dental, vision, or over-the-counter dental and vision products. This account helps reduce taxable income while providing a way to manage out-of-pocket costs.

A Dependent Care FSA lets employees use pre-tax income to pay for qualifying childcare or dependent care services, such as daycare or after-school programs. It is designed to assist working parents or caregivers in managing the costs of dependent care while lowering their tax burden.

$3,300

$5,000

You must be enrolled in the HMO Best Buy or PPO Best Buy in order to elect a Healthcare FSA.

All medical plan enrollees can elect the Dependent Care FSA.

HSA - PayFlex

FSA - Discovery Benefits

Employee

You can elect up to $200,000 when first eligible without answering any medical

questions. Should you elect an amount greater than $200,000, you will be required to

complete a short online medical questionnaire.

Spouse

You can elect up to $40,000 for your spouse when first eligible without answering medical

questions. Should you elect an amount greater than $40,000, your spouse will be required to

complete a short online medical questionnaire.

Child

Coverage is $10,000 for all eligible child(ren).

Stand-alone AD&D

This plan provides additional protection only in the event of a death or injury as a result

of an accident. This coverage is available for you, your spouse, and/or your child(ren).

The Paper Store permits INSURERS to offer Employees of The Paper Store certain voluntary insurance programs. Whether you choose to enroll in any of these programs is completely optional and voluntary. The Paper Store does not make a contribution towards the cost of these programs and Employees pay the full cost of premiums on an after-tax basis. The Paper Store does not sponsor, maintain, endorse, recommend, or promote these voluntary programs. The Paper Store'S involvement regarding these voluntary insurance programs is strictly limited to allowing the insurer access to Employees to publicize these programs and The Paper Store may perform certain ministerial functions such as payroll deduction and forwarding Employee premium payments to the insurer. The Paper Store does not receive any consideration in the form of cash or otherwise in connection with the program, other than reasonable compensation, excluding any profit, for administrative services actually rendered in connection with payroll deductions. Accordingly, these voluntary insurance programs are not subject to ERISA and related regulations. All questions or claims regarding these programs should be directed to the insurer.

Mental health is an important component of your overall wellbeing. Cigna’s whole-person

approach provides dedicated support to help with coping with life events, stress, substance

use, and other behavioral health issues.

Virtual Behavioral Care:

Use your smartphone, tablet, or computer for online video conferencing – for the same cost as a behavioral health outpatient office visit Visit myCigna.com > Find Care & Costs > Doctor by Type > Behavioral Health Counselor > Virtual Counselor to find a provider.

iPrevail:

: On-demand coaching and personalized learning with iPrevail is offered 24/7 to help you boost your mood and improve your mental health – at no cost to you! Work with a peer coach and get access to support communities focused on stress, anxiety, depression, and other mental health challenges. Visit iprevail.com/cigna to sign up and download the free app.

Happify:

: In partnership with Cigna, happify offers science-based activities and games to help you cope with stress and worries. Visit happify.com/cigna to sign up and download the free app.

Our FREE and confidential Employee Assistance Program (EAP) helps you find balance between work and home life. Your EAP benefits cover five counseling sessions per issue, at no cost to you.

The Paper Store offers this program to you and your immediate family at no cost to you.

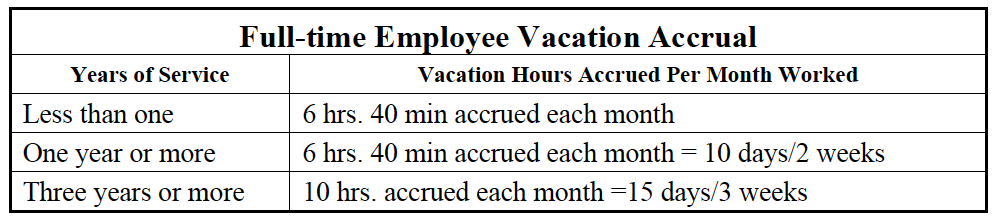

Vacation time with pay is available to regular full-time employees (employees who regularly work 35 or more hours per week) to provide opportunities for rest, relaxation and personal pursuits. Vacation time is accrued at a specific rate per month based upon the employee’s years of service.

Part-time employees who transfer to a full-time position will begin to accrue vacation time beginning on their first day in the full-time position. All employees need to have completed 90 consecutive days of employment to use accrued vacation time. For purposes of determining “Years of Service”, The Paper Store will use the employee’s most recent hire date (in situations where an employee is rehired).

All full-time employees must request vacation time off using myADP.com and their Manager will need to approve.

Vacation time should be used in the calendar year in which it is earned. Unused vacation time in excess of 5 days, will be forfeited at the end of the calendar year. Carried over vacation days must be used in the next calendar year. For example, if, as of December 31st, an employee has 6 days of accrued but unused vacation, the employee may carry over 5 of those vacation days (to use in the next calendar year) and will lose the remaining 1 vacation day.

Accrued but unused vacation time is paid out to employees upon separation of employment.

Vacation time is not considered hours worked for purposes of determining or calculating overtime.

There are “black-out periods” throughout the year when vacation time may not be used, and vacation time requests during these periods will not be approved. Please reference the appropriate EIB for dates.

Exempt employees who work significantly more hours than the norm may be granted “Comp Time” by The Paper Store, at its discretion. Any grant of “Comp Time” will be made via a “Comp Time Grant Form” to be signed by Tom Anderson, Craig Hewitt, Sara Carbonier, Kim Driscoll, Deb Shanley or Vanessa Keefe. “Comp Time” must be used within 364 days of its granting and its use must be approved, in advance, by the employee’s supervisor.

The Paper Store provides paid sick time to employees in accordance with the applicable state sick time law (except where the state has no sick time law). Sick time can be used for periods of temporary absences due to illness or injury of the employee, the employee’s spouse, or the employee’s child. Please note, sick time is not considered hours worked when calculating overtime. Please review the Employee Information Booklet and applicable state addendum for sick policy details.

Sick Time Accrual by State:

Massachusetts & New Jersey

o Accrue 1 hour of sick time per 30 hours worked with an annual accrual and use cap of 40 hours.

o Up to 40 hours can be rolled over each year.

o All employees are eligible.

Connecticut & Maine

o 1 hour of sick time for every 40 hours worked with an annual accrual and use cap of 40 hours.

o Up to 40 hours can be rolled over each year.

o All employees are eligible.

New Hampshire & Florida

o Accrue 1 hour of sick time for every 40 hours worked with an annual accrual and use cap of 40 hours.

o Up to 40 hours can be rolled over each year.

o Full-Time employees are eligible.

Rhode Island

o Accrue 1 hour of sick time for every 35 hours worked with an annual accrual and use cap of 40 hours.

o Up to 40 hours can be rolled over each year.

o All employees are eligible.

New York

o Accrue 1 hour of sick time for every 30 hours worked with an annual accrual and use cap of 56 hours.

o Any accrued but unused vacation time will roll over year to year.

o All employees are eligible.

All full-time employees receive six paid holidays a year:

o New Year's Day

o Memorial Day

o Fourth of July

o Labor Day

o Thanksgiving Day

o Christmas Day

An FSA saves you money by reducing your income taxes. You must choose how much to contribute

each year, up to the stated limit. Your FSA contributions are automatically deducted from

your pay BEFORE any taxes are calculated, and are not reported as income to the IRS. The FSA

plan is effective January 1 to December 31 (calendar year).

Existing Employees may

enroll during Open Enrollment. New Hires must fulfill their eligibility requirements prior

to enrolling.

✓ Contributions are pre-tax and are automatically deducted

✓ Funds do not rollover from year-to-year

With this coverage, you can deliver peace of mind to your family in the event of your unexpected death.

✓ Receive up to 2x your annual salary up to a maximum of $250,000

✓ Living Benefit allows you to collect 80% of your policy while living in the event you are diagnosed with a terminal illness

✓ You may be able to keep coverage if you leave the company, retire or change the amount of hours you work

If you’re suddenly unable to earn a paycheck due to illness or an accident, short term disability insurance through your employer can replace a portion of your income during the initial weeks of your disability.

✓ Receive a portion of your salary for 25 weeks

✓ Off-the-job coverage

Long term disability insurance through your employer can provide a steady stream of income to help cover essential expenses during an extended illness or after a disabling accident.

✓ Offers additional coverage beyond your initial Short-Term disability coverage

MetLife

Short-Term Disability (STD) is a salary continuance plan. If you become ill or injured and

are unable to work,

a portion of your income will be replaced through a combination of sick leave, State

Disability Insurance

(where available) and the Company’s Short-Term Disability benefit for up to 25 weeks.

Your

STD benefits

begin on your eighth day of disability and continue until you are able to return to work or

25 weeks,

whichever happens first. This benefit is provided at no cost to you.

If you exhaust your STD benefits and are still unable to work, you will be covered by LTD insurance at 60% of your salary, to a maximum of $13,000/month.

Progyny

Fidelity

Accident - The Hartford

Legal/Identity Theft - LegalShield

Pet Discount

Employee Discounts

Critical Illness - Chubb

We are proud to offer you paid parental leave. From our family to yours, time to bond with your bundle!

For primary caregivers:

Up to 12 weeks of paid leave at 100% of your base pay

For all other parents:

Four weeks of paid leave at 100% of your base pay

Enrolling in this program is an important first step toward a healthy future for you and your baby. All Cigna Healthy Pregnancies, Healthy Babies services are confidential, and your private information will not be shared with The Paper Store.

Plan for a Healthy Pregnancy:

When you enroll before becoming pregnant, we can help you be as healthy as possible. You’ll have access to preconception planning tools and resources, including information from the March of Dimes on eating right, maintaining a healthy weight, taking prenatal vitamins, stopping alcohol and tobacco use, and controlling any medical conditions you may have.

Support During Your Pregnancy:

Tell Cigna about your pregnancy so they can meet your needs. You can ask them anything – your coach, who has a nursing background, is there to support you during your whole pregnancy. You’ll even get a pregnancy journal with information, charts, and tools to help you have a happy nine months.

Start Now:

Cigna can help you stay healthy before and during your pregnancy and in the days and weeks following your baby’s birth. Call 800-615-2906 to enroll today. Download the new app by searching for “Cigna Healthy Pregnancies” in the App Store to get support through your entire pregnancy with tips and tools.

Manage your parenthood journey with Ovia Health! From preconception to returning to work and navigating life as a new parent, Ovia offers three apps to guide you on your journey.

Fertility:

Track your period, symptoms, moods and more! Receive accurate predictions for period and ovulation, connect with an anonymous community of women and read personalized summaries of your health and fertility.

Pregnancy:

Follow your baby's growth by tracking pregnancy, symptoms moods and more. Connect with other moms-to-be for support, check food and medication with safety lookups, and more.

Parenting:

Celebrate memories and milestones by inviting friends and family to follow along, upload photos and videos of precious moments, and track your child's growth and development.

Employees and participating Spouse/Domestic Partners covered by a Niagara

medical plan as of 1/1/2021 may voluntarily participate in the Hydrate Your

Health Program. For Employees, your participation helps you avoid paying the

Wellness Surcharge, an additional medical premium beginning in May 2021. The

surcharge is $40 per paycheck for Employees. There will not be a surcharge

for spouses in 2021, but spouses are encouraged to participate.

A wellness surcharge of $40/pay period will apply to Employees if the

following actions are not taken by the deadlines:

| Activity #1: PHQ | Activity #2: Biometric Screening OR Coaching | |||

|---|---|---|---|---|

| Activity | PHQ Online Questionnaire |

Option 1: Quest Patient Service Center Lab |

Option 2: At Home Self-Collection Test Kit |

Option 3: Complete 4 Wellness Coaching Sessions |

| Deadline |

Complete between 12/15/2020 - 2/28/2021 |

Complete between 12/15/20 - 2/28/2021 |

Complete between 12/15/2020 - 5/4/2021 to avoid surcharges; complete by 9/30 to earn a refund | |

Get immediate access to specialized professionals in counseling, social work, human services and psychology. You have access to the LifeWorks network of thousands of master’s level counselors and affiliates.

✓ Get support with financial and legal issues

✓ Receive 5 free appointments included in your Niagara benefits

✓ Enjoy hassle-free scheduling with LifeWork's easy-to-use app

The Hydrate Your Health Wellness Program is designed to maintain a high level of

well-being through nutrition, activity, stress management, and illness prevention &

management.

For your first year at Niagara, you may voluntarily choose to participate in our

wellness challenges and other wellness programs through Virgin Pulse, a global leader in

health and wellness. After your benefit effective date, you will have access to this web and

app-based program, where you can track your healthy habit development!

For Employees enrolled in a Niagara medical plan, your voluntary participation

can earn you Pulse Cash! You and your spouse can earn up to $100 each by completing various

activities, such as: Niagara sponsored wellness challenges, healthy habit trackers, goal

setting, daily wellbeing tips, sleep guide, nutrition guide, & digital coaching.

If you choose not to enroll in a Niagara medical plan, that’s okay. You can still

join your team and colleagues on our wellness adventures and take advantage of all of the

same tools and resources. But no Pulse Cash for you.

Do you ever wish you had accountability for fitness or healthy eating?

Partner with a FREE coach to work on areas you wish to improve. Topics include: Get Active,

Eat Healthy, Reduce Stress, Manage Weight, Navigate Health Situations, Tobacco Cessation,

and Sleep Well.

What about Biometric Screenings?

You may have heard that Niagara offers Biometric Screenings to Employees and covered

partners. That is true! The biometric screening program is offered to those covered team

members and partners enrolled as of January 1st.

If you continue to enroll in a Niagara medical plan next year, you will be included in our

2022 program. For this year, focus on improving or maintaining your good health and joining

your colleagues on some fun wellness adventures!

Select the plans you are interested in enrolling in to view your monthly or annual per-pay-period deductions.

By combining cutting-edge science and the largest custom network of fertility specialists in the nation, Progyny delivers superior clinical outcomes and shortens the path to pregnancy.

✓ Offered to Aetna and Capital BlueCross members; Kaiser members have their own benefit

✓ In vitro fertilization, egg freezing, surrogacy, and adoption education support

✓ Integrated pharmacy benefit through Progyny Rx

✓ Patient Care Advocates are available now to answer questions – call (833) 205-3998 from 9-5 ET.

With appropriate Company approval, employees will be eligible for reimbursement up to $5,250 for classes

after the

completion of 180 days of employment. Eligible employees include all active regular,

full-time/part-time

(30+hours/week), exempt, non-exempt, and hourly employees.

Tuition reimbursement will be provided for

accredited courses or programs of study directly related to the employee’s present job or

those courses/

programs which will enhance their opportunity for advancement. Both degree and non-degree

courses are

eligible for reimbursement.

Workers’ Compensation is a federally mandated benefit and provides wage replacement and medical benefits to employees who have sustained a work-related injury. If you are injured at work, you should immediately report the injury to your supervisor.

No cost to you!

The Paper Store provides you with $10,000 of Basic Life and AD&D

insurance FREE. You are automatically enrolled in this coverage.

No cost to you!

Available to full-time employees who have completed their introductory period. Short-Term disability offers partial pay for a short period of necessary medical leave for eligible employees.

Long-Term disability is an elected benefit that covers a portion of income should coverage be needed beyond short-term disability coverage. Coverage levels and associated premiums vary.

Life and AD&D offers financial security to designated beneficiaries should something happen to you. Coverage levels and associated premiums vary. For first-time enrollments, any coverage level over $200,000 requires approved evidence of insurability (EOI).

Accident Insurance offers fixed benefits payable to you if you experience an injury from an accident. Coverage levels and associated premiums vary. The Accident Plan is a 24-hour plan instead of an off-the-job plan. You have two plan options to choose from: the High plan and Low plan.

The Critical Illness benefit will help you to cover expenses related to a serious illness, such as lost income, childcare, travel to treatments, high deductibles, and co-pays. You have two plan options to choose from: the High plan and Low plan.

Hospital Indemnity coverage picks up where other insurance leaves off and provides cash to help cover hospital expenses. You have two plan options to choose from: the High plan and Low plan.

Pet Assure Veterinary Discount Plan: $8.00/month for one pet or $11.00/month for an unlimited number of pets.

Learn more →

PetPlus Prescription Savings Plan: $3.75/month for one dog or cat or $7.50/month for all of the dogs and cats in your home.

Learn more →

PetsBest: A pet health insurance plan that offers 90% reimbursement on accidents and illnesses. You must contact PetsBest for a quote.

Learn more →

LifeWorks

Compliance Notices

Privacy

Summary of Benefits and Coverage (English)

Summary of Benefits and Coverage (Spanish)

Medicare Part D Notice

Plan Document

Wrap Summary Plan Document

Premium Conversion Document

Part A (Hospital Insurance):

Helps cover inpatient care in hospitals, skilled nursing facility care, hospice care, and home health care.

Part D (Drug coverage):

Helps cover the cost of prescription drugs (including many recommended shots or vaccines). You join a Medicare drug plan in addition to

Original Medicare, or you get it by joining a

Medicare Advantage Plan

with drug coverage. Plans that offer Medicare drug coverage are run by private insurance companies that follow rules set by Medicare.

Medicare Supplemental Insurance (Medigap): Extra insurance you can buy from a private company that helps pay your share of costs in Original Medicare. Policies are standardized, and in most states named by letters, like Plan G or Plan K. The benefits in each lettered plan are the same, no matter which insurance company sells it.

With TOC, you may be able to receive services for medical or behavioral health through providers who are not in UHC’s network. This care is for a defined period of time and typically applies to members actively in a course of treatment like acute conditions, severe chronic conditions, pregnancy, terminal illness, the care of a child ages 0-36 months, previously scheduled surgery or other procedures.

Call or text the Piper Jordan Claim Advocates at 833-561-1630 (8am - 5pm PST) or email tpssupport@piperjordan.com